will i get a tax refund if i receive unemployment

Although many filers may have expected that they would receive another break this year this is not the case as unemployment benefits will count as taxable income. Advertisement If the IRS determines you are owed a refund on the unemployment tax break it will automatically correct your return and send a refund without any additional action from your end.

Unemployment Tax Refund Still Missing You Can Do A Status Check The National Interest

Youll receive Form 1099-G which shows the amount of unemployment income paid.

. Again the answer here isRead More. The federal tax code counts jobless benefits as. A generous payout for the earned income credit could offset some taxes that will be.

However there are some. While taxes had been waived on up to 10200 received in unemployment for those making less than 150000 in 2020 -- the first year of the pandemic -- that was only temporary relief and no such tax. In December 2021 the IRS sent the CP09 notice to individuals who did not claim the credit on their return but may now be eligible for it.

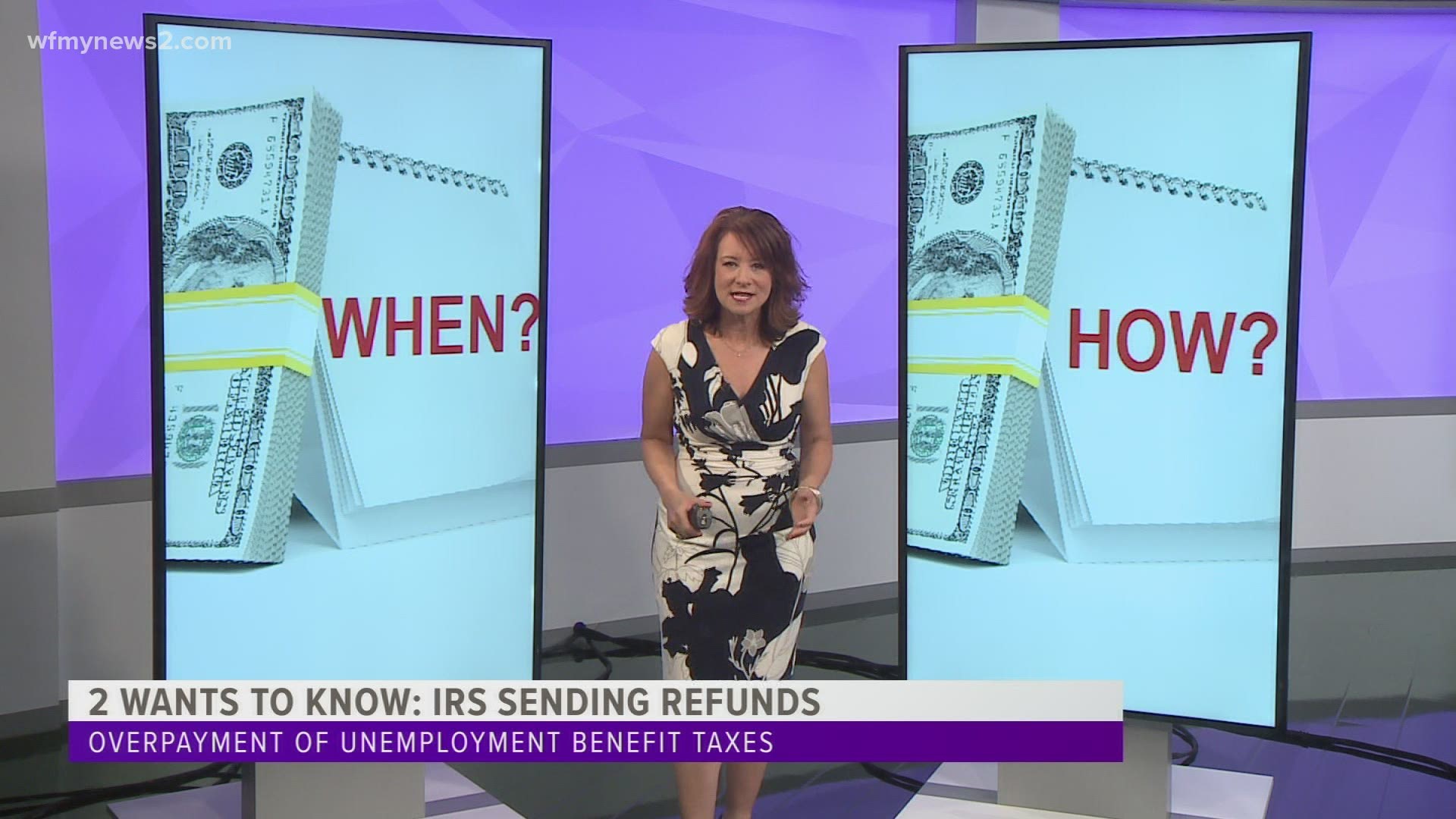

Not everyone will receive a refund. Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30. You will get the additional refund if all of the following are true.

Illinois expects to start cutting refund checks. Because we made changes to your 2020 tax account to exclude up to 10200 of unemployment compensation you may be eligible for the Earned Income Credit. Your tax on Form 1040 line 16 is not zero.

The Internal Revenue Service is reviewing the tax returns of 10 million people and will begin issuing additional refunds this week to those who paid too much in taxes for their 2020 unemployment benefits. I therefore would be inclined to think that you do not need to report it but you should call your unemployment office to ask them. What is the IRS Treas 310 tax refund.

Unemployment compensation is taxable income. Many states are continuing to address rising inflation with tax rebates and stimulus checks. However if you havent yet filed your tax return you should report this reduction in unemployment income on your Form 1040.

If you already filed your 2020 tax return and you did not get the unemployment exclusion on the tax return that you filed the IRS will recalculate your tax return and send you an additional refund. Will unemployment affect my 2020 tax return. Congress made up to a 10200 in jobless benefits payment in 2020 tax-free for people earning less than 150000 a year.

People who received unemployment benefits last year and filed tax returns on that money could receive the extra funds the IRS said in a press release. When can I expect my unemployment refund. The IRS identified over 10 million taxpayers who filed their tax returns prior to the American Rescue.

These taxpayers are getting a refund because they had already reported their unemployment compensation on their 2020 tax returns before the American Rescue Plan ARP was signed into law. This is the fourth round of refunds related to the unemployment compensation exclusion provision. Some taxpayers who had their 2020 returns readjusted may not get a refund because the IRS first applied their overpayment to outstanding taxes or other debts owed at the state or federal level.

You typically dont need to file an amended return in order to get this potential refund. Luckily you may be able to offset some of those taxes. Since many did not have taxes withheld they could face a tax bill.

In other words you could have adjusted your tax withholding on a W4 form while you were employed in order to be taxed less on each paycheck so this is money you were taxed that the IRS owed you back. Taxpayers should not have been taxed on up to 10200 of the unemployment compensation. There is unemployment income on Schedule 1 line 7.

You can choose to make quarterly estimated tax payments on such unemployment income or have federal income tax withheld. The American Rescue Plan Act of 2021 excluded up to 10200 in unemployment compensation per taxpayer from taxable income paid in 2020. Most people do not have to take any action or file an amended return to get a refund if they overpaid on unemployment compensation according to the IRS.

Instead the IRS will adjust the tax return youve already submitted. If you want to have income tax withheld from your unemployment request the payer to withhold the amount by submitting Form W-4V. Youll receive your refund by direct deposit if the IRS has your banking information on file and a paper check if not.

This notice is not confirmation that you are eligible. It might take several months to get it. Your Adjusted Gross Income AGI not including unemployment is less than 150000.

Since May the IRS has issued over 87 million unemployment compensation refunds totaling over 10 billion. FORM 1099-G According to Mark Steber chief tax information officer at Jackson Hewitt Tax Service theres a way to collect unemployment benefits in 2021 as taxable income. This is not the amount of the refund taxpayers will receive.

If Schedule 1 line 8 is blank the IRS will recalculate your tax return and send you a refund for the unemployment exclusion if all of the following are true. Jobless benefits are generally taxable. People might get a.

The deadline to file your federal tax return was on May 17. Theres no exclusion this year. Are you eligible for unemployment tax refund.

If you didnt pay taxes on your unemployment checks as you received them your tax refund may be used to pay for the taxes that you owe resulting in a smaller refund. The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020. A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year.

May 14 2021 131 PM 2 min read. However Congress made an exception for the 2020 tax year because of the COVID-19 pandemic which caused job.

Confused About Unemployment Tax Refund Question In Comments R Irs

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Unemployment Tax Refund Could Put Thousands Back In Your Pocket

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill

Unemployment Tax Refund Update What Is Irs Treas 310 Weareiowa Com

Irs Unemployment Refunds Moneyunder30

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Usa

If You Were On Unemployment Last Year You Ll Probably Get A Tax Break Marketplace

Taxes Q A How Do I File If I Only Received Unemployment

Irs Starts Sending Unemployment Benefits Tax Refunds To Millions Of Taxpayers Plus More Special Refunds Payments On The Way

Unemployment Tax Refund Update What Is Irs Treas 310 11alive Com

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Transcript Help Am I Getting The Unemployment Refund What Does 291 Mean R Irs

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Still Waiting For Your 10 200 Unemployment Tax Refund How To Check Status Dailynationtoday

Your Tax Refund May Be Late The Irs Just Explained Why The Washington Post